- How do I add a Stock?

- How do I delete a Stock?

- Adding a Custom Instrument

- How do I Add Preferred Stocks?

- What is the Format for Stock Symbols?

- How do I add Another Portfolio?

- How do I delete a Portfolio?

- What is Current Yield versus Yield on Investment?

- When Do I Renew My Subscription?

- How Do I Renew My Subscription?

- How Do I Cancel My Subscription?

- How do I Create A New Account?

- How do I Share a Portfolio Across Devices?

- How do I view my portfolio on the web?

- How do I Restore My Data ?

- What is the Purpose of the Override Switch?

- Why do you charge for a data subscription?

- How many stocks without a subscription?

- Is the Data Realtime?

- What if I see a mistake in the data?

- What does the asterisk mean?

- What stocks do you cover?

- How is currency supported in the app?

- How do I set the overall currency for the app?

- How do I set the currency for a portfolio?

- How do I set the currency for a stock?

- Which currencies are supported in the app?

- What does the exclamation mark mean?

- How is Annual Calculated?

- How is UnRealized Gain Calculated?

- How to reset your password?

- How to delete your account?

- What happened to Dividend Predictor.

- Differences between iPhone and Android app.

Adding a Stock

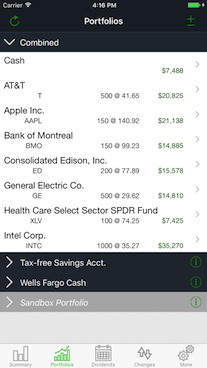

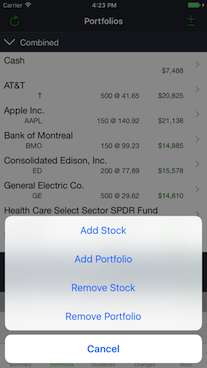

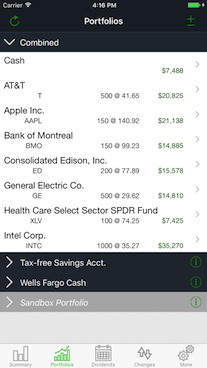

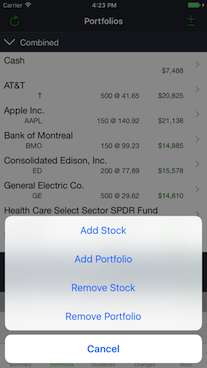

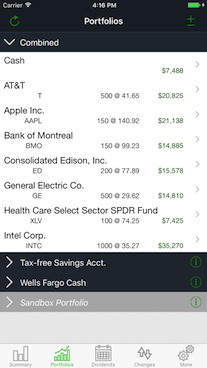

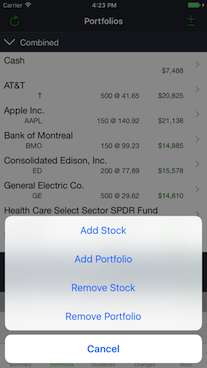

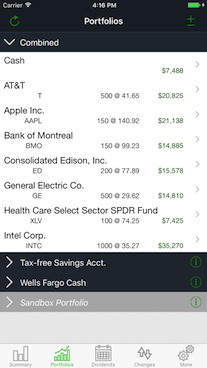

Go to the Portfolios tab and tap the  in the top right

hand corner and then select 'Add Stock' from the slide up menu.

in the top right

hand corner and then select 'Add Stock' from the slide up menu.

➝

➝

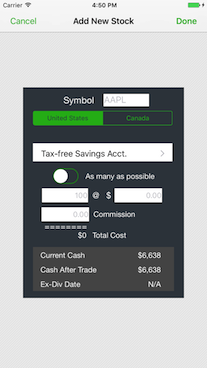

Enter the ticker symbol and then select whether the stock is listed in the US or Canada, and the number of shares that you want. If you have multiple portfolios you can also select which portfolio the stock will be added to, with the default being the currently expanded portfolio. When you are entering the number of shares the app will retrieve the stock details and display the name and last close price.

Tap Done at the top right to finish adding the stock

Deleting a Stock

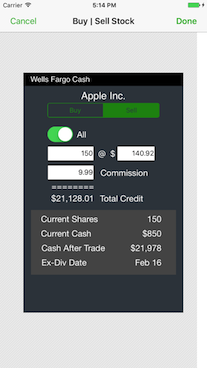

To remove a stock from your portfolio just sell all of your holdings of it. From the Portfolios tab tap on the stock that you want to delete to show the stock details, then tap on Buy Sell at the top right.

➝

➝

In the Buy Sell dialog tap Sell and All then Done. Once you have sold all of your holdings the stock will be removed from your portfolio.

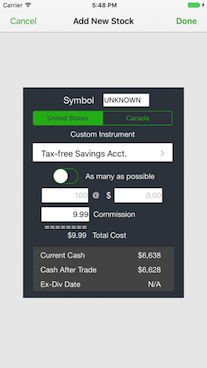

Adding Custom Instruments

Use the custom ticker feature to simulate bonds or other financial instruments that are unsupported.

Tap the  in the top right-hand corner

and then select

in the top right-hand corner

and then select

➝

➝

In the ticker symbol field enter "unknown". Beneath the input field, the title "Custom Instrument' appears. Now you can enter the number of shares, the commission rate (if applicable) and click Done.

Go to the stock details page to override each value on the custom instrument, including the name and its value. See the Overrides section of the FAQ

How do I add Preferred Shares?

Preferred shares don't have a standard naming convention. For a good overview of preferred shares naming conventions please see: Preferred Share Naming Conventions .

Dividend Pro doesn't have all of the payment data for all preferred shares at this time, however the app should be able to add them, where you will be able use the overrides to set the payment amount and dates. We are following the naming convention used in Google finance, so for example the symbol for BMO Preferred Class B Series 5 is 'BMO-H'.

What is the Stock Symbol Format?

Dividend Pro follows the format of the exchanges on which the stocks are listed. Check the stock lookup for the appropriate exchange if you are having difficulty finding a symbol: NYSE, NASDAQ, TSXSpecify the symbol and the country. Dividend Pro will determine which exchange the instrument is traded on.

Some examples are listed below

- 'GE' - General Electric Company on NYSE

- 'RDS.A' - Royal Dutch Shell PLC on NYSE

- 'REI.UN' - RioCan Real Estate Investment Trust on TSX

How Do I Add Another Portfolio?

Go to the Portfolios tab and tap the  in the top right

hand corner and then select 'Add Portfolio' from the slide up menu.

in the top right

hand corner and then select 'Add Portfolio' from the slide up menu.

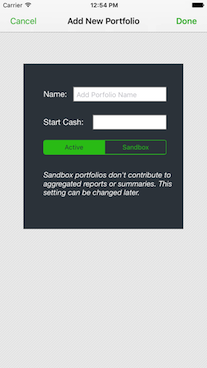

➝

➝

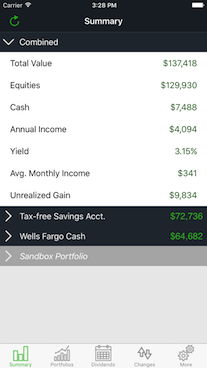

Choose whether the portfolio is 'Active' or 'Sandbox'. Active portfolios have their positions included in the combined holdings summary, whereas sandbox portfolios exclude them.

How Do I Delete a Portfolio?

From the Portfolios tab, tap the 'info' button ('i' inside a circle) beside the portfolio that you want to delete to show the Portfolio Details page.

➝

➝

Tap the garbage can icon at the top-right to delete the portfolio. Note that all stocks in the portfolio will also be deleted!

What is Current Yield versus Yield on Investment?

Current Yield is the yield based on the latest price of the stock, whereas Yield on Investment is the yield based on your purchase price.

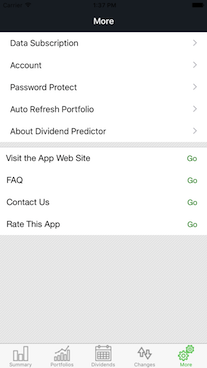

When Do I Renew My Data Subscription?

Dividend Pro now uses Apple's Auto-renew Subscriptions, so you don't need to take any action to have your subscription continue.

How Do I Renew My Data Subscription?

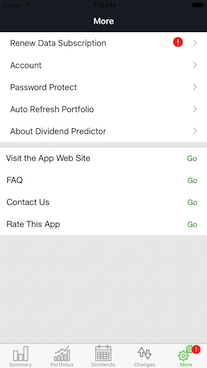

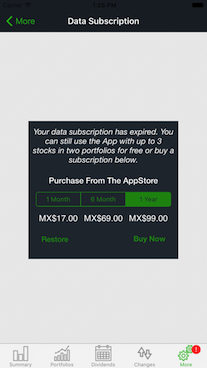

Dividend Feed Subscriptions are purchased within the app. When you first install the app you will receive a free unlimited one month subscription. Once a subscription has expired you will see a red exclamation mark on the More tab at the bottom right of the app, and also on the first item on that page. When your subscription expires your portfolio will temporarily be limited to 3 stocks in each of 2 portfolios until you renew. Once you purchase your subscription your full portfolio will be visible again. Don't worry, we don't delete your data!

Dividend Pro now uses Apple's Auto-renew Subscriptions, so you don't need to take any action to renew once you have purchased. You can cancel at any time by following instructions in the next FAQ item.

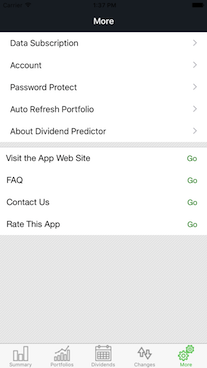

Tap More ➝ Renew Data Subscription to show the Purchase Dialog.

➝

➝

How Do I Cancel My Data Subscription?

Our Dividend Feed Subscription uses Apple's Auto-Renew subscriptions that you can cancel yourself on your device by following the steps in this Apple Support article: View, Change or Cancel Your SubscriptionsHow Do I Create A New Account?

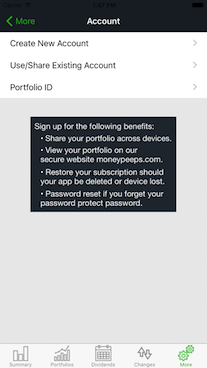

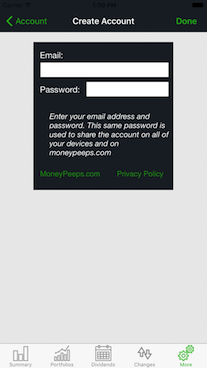

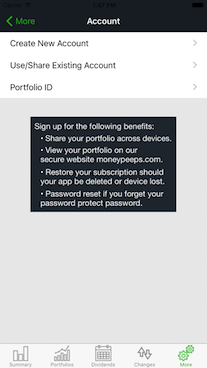

Creating an account with MoneyPeeps allows you to share your portfolios across multiple devices, view them on our secure website, and restore your portfolios should you need to. You can create an account from within the app on your device (the one from which you bought a subscription) by tapping More ➝ Account ➝ Create New Account.

➝

➝

Enter a valid email address and then choose a password. Once registered, a confirmation will be emailed to you.

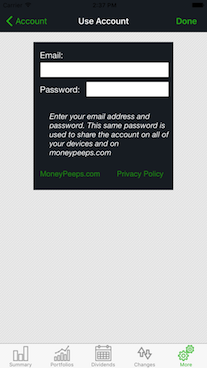

How Do I Restore My Portfolios?

If you have created an account with MoneyPeeps, you can restore your portfolios by entering your MoneyPeeps email address and password within the Dividend Pro app by tapping on More ➝ Account ➝ Use/Share Existing Account.

➝

➝

Enter the email address and password you used when you created your account and tap Done at the top-right and you will be connected with your existing portfolios.

How Do I View My Portfolio on the Web?

If you have created an account with MoneyPeeps, you can view your portfolios on our secure website. Login to MoneyPeeps.com and choose My Dividends or My Portfolio

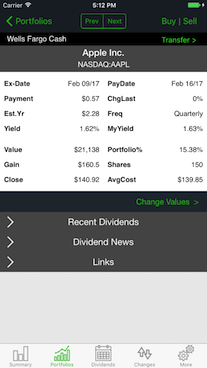

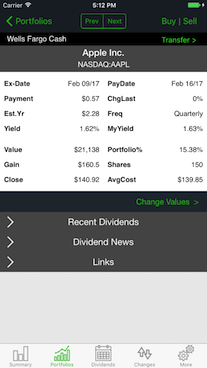

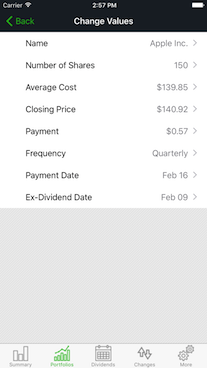

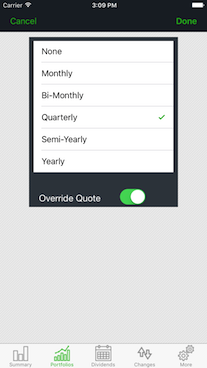

What's the purpose of the overrides?

You can override the stock values such as frequency, payment dates, etc. While we cover more than 5,000 of the most traded US and Can. stocks you may encounter instruments that we don't cover such as mutual funds and some preferred stocks. In this case you may edit the stock details, and then switch the override button to 'on'. If override is on for a particular stock detail, the device remembers those settings. A lock icon

appears next to the stock details that have been edited. Overrides you entered are saved with your portfolio on the server.To set an override tap on Change Values just below the stock details and before the Recent Dividends section.

➝

➝

Why a Subscription?

Our dividend data feed is not free so a subscription is the fairest payment model to reflect that cost. If there was no charge for the data we would happily use a flat fee for the App.

How Many Stocks without a Subscription?

Without buying a subscription, Dividend Pro allows you follow two portfolios with three stocks in each one.

Is the Data Realtime?

No. Closing prices are updated a half hour after market close.

What if I see a Mistake in the Data?

If you see a mistake, you can use the override switch to input the correct data. At the same time, please inform us of the error and we will update our database.

You can let us know in the forum or you can email us directly at:

What does the asterisk mean?

While our data set is comprehensive, some stocks may be not be covered within the database. (See below for information on coverage) In the event, that our your ticker symbol was not found in our database, Dividend Pro returns an update message and also shows an asterisk icon next to the stock. To manually update the dividend information, use the override switch.

An asterisk will also appear next to an item which has its override set.

An asterisk is also used to indicate items in the dividend report that have been extrapolated from known values.

What stocks do you cover?

The stocks covered by Dividend Pro and the MoneyPeeps database are primarily US traded equities that are traded on NYSE, NYSEMKT, NASDAQ, ARCA exchanges, Canadian stocks on TSX, plus many ETF's, closed end funds and larger cap mutual funds. Specifically, we offer about 4,500 traded stocks plus about 700 Canadian traded stocks, which represents the universe of companies covered by professional sell-side analysts on Wall Street.

If there is a stock that we are not covering that you would like to see added please contact us at our support email.

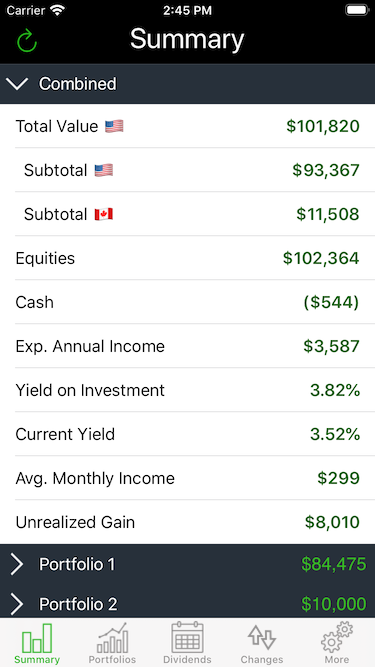

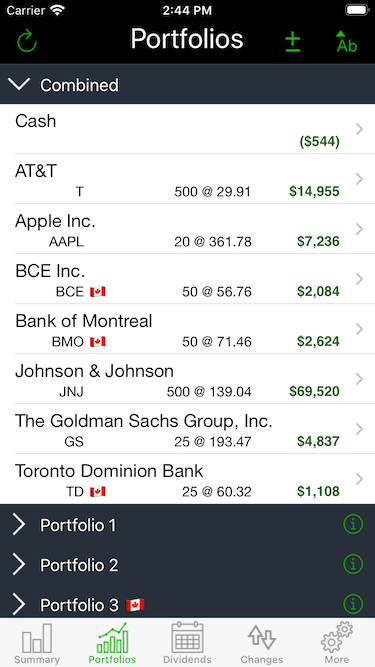

How is currency supported in the app?

Currency is presented in the app in a number of different ways; the overall Account Currency of the app, each Portfolio Currency and each Stock Currency.

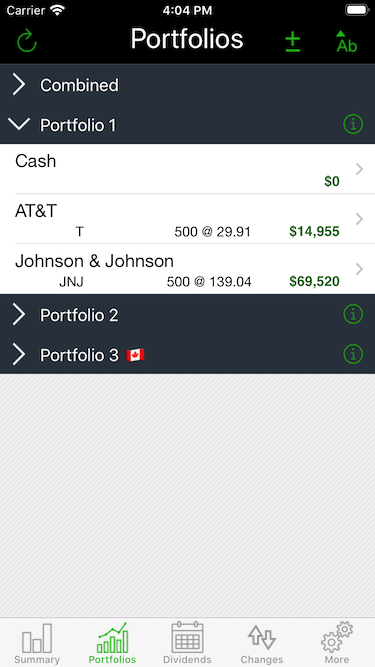

How these are set will control the display of currency flags, represented by flags of the corresponding region:  To avoid distracting clutter the currency flags are only displayed when the currency in question is different from the currency of the context that it is in, and if all of your portfolios and stocks are in the

same currency you shouldn't see any currency flags. For example

if the Account Currency is USD then any portfolios that are in the same currency will not display currency flags. Only portfolios

that are different from the Account Currency will display the currency flags. The following image shows an Account Currency in USD,

Portfolio 1 and Portfolio 2 are also in USD so the don't display currency flags, and Portfolio 3 is in CAD so it does display the currency flag.

To avoid distracting clutter the currency flags are only displayed when the currency in question is different from the currency of the context that it is in, and if all of your portfolios and stocks are in the

same currency you shouldn't see any currency flags. For example

if the Account Currency is USD then any portfolios that are in the same currency will not display currency flags. Only portfolios

that are different from the Account Currency will display the currency flags. The following image shows an Account Currency in USD,

Portfolio 1 and Portfolio 2 are also in USD so the don't display currency flags, and Portfolio 3 is in CAD so it does display the currency flag.

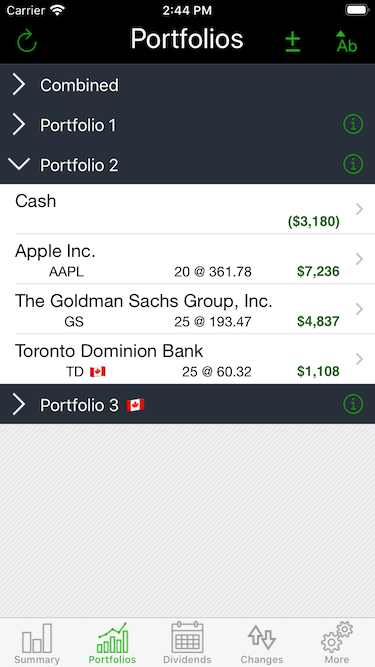

The same holds true at the portfolio level. For example if the Portfolio Currency is USD then any stocks that are in the same currency will not display currency flags. Only stocks that are different from their Portfolio Currency will display the currency flags. The following image shows an Account Currency in USD, Portfolio 1 and Portfolio 2 are also in USD so the don't display currency flags. Within Portfolio 2 one stock has CAD currency. Since it is different from its portfolio it will display a currency flag.

Stocks can have two different currencies so the display of the currency flags will depend on whether it is the stock price or value being presented or the dividend amount or income. The following image showing the stock details page presents a stock listed on TSX, a Canadian exchange, in CAD, however its dividend is declared in USD. Notice that the Payment item has a currency flag to indicate the difference, and at the bottom the Recent Dividends section also has a currency flag.

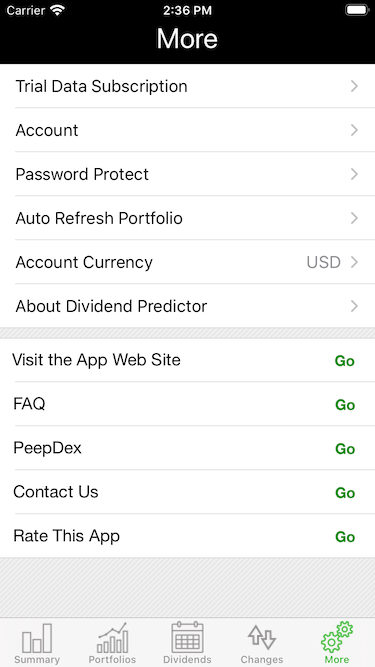

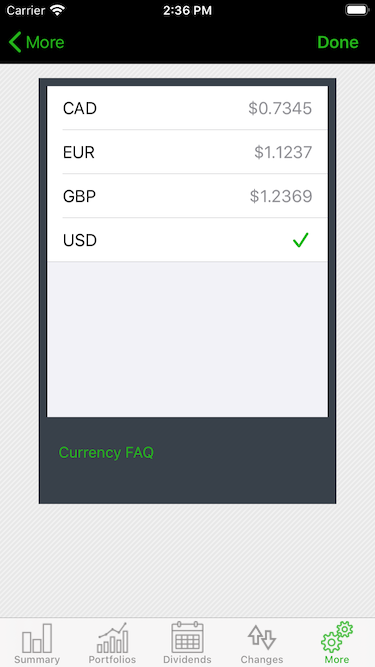

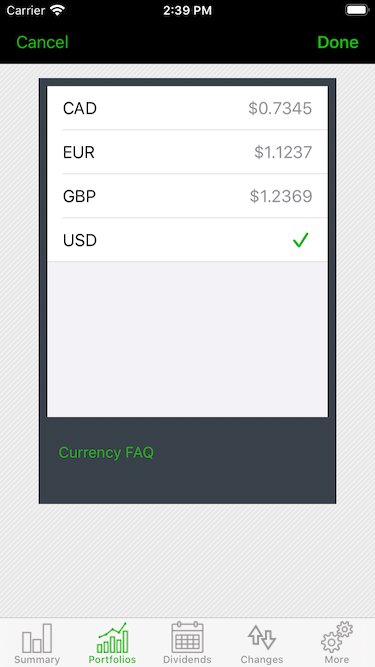

How do I set the overall currency for the app?

The overall Account Currency sets the default currency for the app. Go to the More tab and tap on the Account Currency item. The currency options will show the exchange rates for the selected currency.

➝

➝

How do I set the currency for a portfolio?

Each Portfolio can have its own currency. Go to the Portfolios tab and tap on the Info item at the right hand side of the Portfolio header (an 'i' inside a circle). The currency options will show the exchange rates for the selected currency. Select the currency that you want and tap on Done at the top right.

➝

➝

How do I set the currency for a stock?

A stock can have two different currencies; one for its price, and one for its dividend. Some stocks are listed on an exchange in one currency, but their dividends are declared in a different currency. This usually happens with stocks that are cross listed on multiple exchanges. Stock or dividend currency are not user settable. If you see an error with a stock or dividend currency please contact our support team.

Which currencies are supported in the app?

The overall Account Currency and individual Portfolio Currencies can be set to CAD, EUR, GBP or USD. For the moment only US and Canadian exchanges are supported so stocks and dividends will only be in CAD or USD.

What does the exclamation mark mean?

When you see an exclamation mark

next to some of the stock details, it means that Dividend Pro did not find those details. You can use the override switch and enter your information for that particular stock.What does Annual Indicate?

The Annual Dividend is the estimated dividends over the upcoming year based on the most recently paid or announced dividend (as opposed to the Trailing Amount). For example if the most recently announced dividend payment for a stock is $0.25 and the dividend is paid quarterly then the Annual Dividend will be estimated at $1.00.

How is Unrealized Gain Calculated?

From the day you purchased a subscription for Dividend Pro, your portfolio's unrealized gain (or loss) will be shown on the combined holdings tab of the summary page within the app.

At present the figure is cumulative, and it cannot be graphed, but we hope to expand this feature in a later release, so that you will be able to track gains and losses over time.

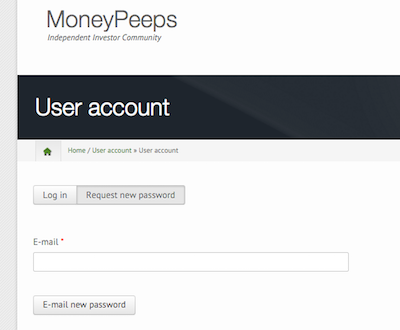

How to reset your password?

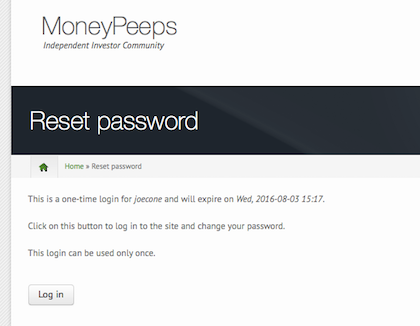

If you have registered your account with us or shared your account across multiple devices you will have supplied an email address and password that also allows you to access your portfolios on our website. If you need to reset your password you can use this link, https://moneypeeps.com/user/password, and you should see the following screen.

Enter the email address that you used to register, then click the 'Email new password' button and you should shortly receive an email with a one-time login link. If you click on the link you will be taken to the following screen:

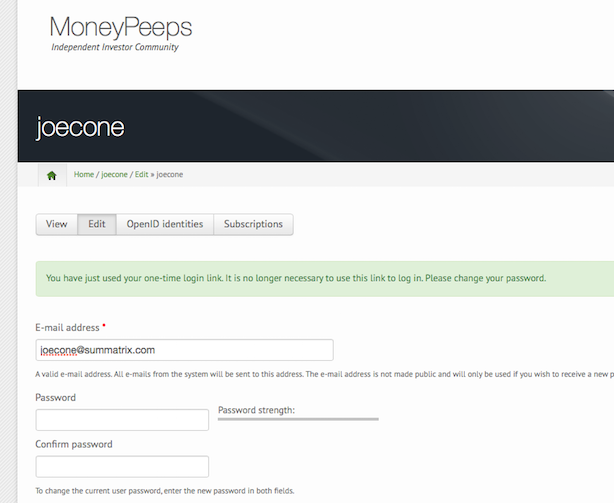

Click on the 'Log in' button and you will be logged in to moneypeeps.com and taken to the following screen:

Enter your new password in the 'Password' field, and again to confirm in the 'Confirm password' field, then scroll to the bottom of the page and click 'Save' and your new password should be set.

How to delete your account?

If you have registered your account with us on this website you can delete your account and all data here also. If you did not register you will not have any personally identifying data on this site or in the app.

To delete your account, first login to the website using the link here: https://moneypeeps.com/user. Once you have logged in click on 'My Account' at the top left. Next, click on the 'Edit' button to allow you to modify the account settings. Scroll to the bottom and click on the "Cancel" button, and confirm. All of the data associated with your account will be permanently removed.

What happened to Dividend Predictor?

Dividend Predictor is now Dividend Pro. As the app has evolved the early origins of the name became less relevant, and the new name more appropriate.

The Android and iPhone apps are so different. How come?

The iPhone and Android apps are related, but different. The Android version is app-based, whereas, the iPhone App is cloud-based so portfolios can be shared across devices and viewed on the web. The iPhone app also has multiple portfolios, auto-update, unrealized gain, stock detail overrides, custom instruments, cash balances and many other features.